Long term care can be difficult, both financially and physically for older adults as well as their families. We hope this guide will help you plan and navigate long term care for yourself effectively.

Contents

When a person retires, he starts to think about the peace and independence it will offer him. But this thinking is far from reality.

Every stage of life has its challenges. In earlier stages of life, your work might be your source of stress. But as you age and retire, your health takes its place.

In these circumstances, a proper retirement plan that can cover any unforeseen event of the future is a must. Investing in long-term care service insurance seems like an excellent option to consider.

With your age, if you get any chronic diseases that can affect your mobility and ability to manage yourself completely, this is where these services come into play.

It will provide you with customized care according to the degree of your disability or illness. It will offer you the flexibility of staying at your own home and getting care, or you can stay in nursing homes and community condos.

In this article, we will dive deep into various long-term care options available in our country for elders. We will talk about common myths associated with it. We will assess every option one by one and its viability for you, and we will help you make your decision-making a more calculated one.

Long Term Care Myths

While opting for any type of service, it is advisable to have questions, but myths will make you pass many highly rewarding opportunities. The decision of a suitable retirement plan is not indifferent to this general theorem of thinking.

We have listed down some common myths of a person considering his retirement plan and worrying unnecessarily.

Associating Long-term Care With Age

People think they are not old enough to worry about long-term care services. But in reality, more than 40% of the people who receive long-term care services are less than 64 years of age. So it doesn’t matter that you don’t consider yourself old enough. At some point, almost everyone will surely need such care in life.

Only Nursing-homes Provides This Service

This is another common myth that most people harbor in their minds. But it is not entirely true. There are various other services in long-term care. Some might even treat you in the safe and comfortable environment of your home, and some might allow you to stay with people of your age.

My Insurance Will Only Cover Nursing homes

The insurance companies that provide long-term care insurance do not cover only nursing homes. There are various other services like home care, retirement homes, and community condos that they cover.

When taking insurance, ask your insurance advisor about these things and then make any decision.

Thinking your family is always here for you

This might sound a bit harsh to you that we categorize this as a myth.

At any point in life, situations don’t remain the same as they are now. Your family and friends may love you a lot. But they could not always be there for you as they have their own life.

You need to understand and accept it and therefore take a more objective decision.

Long-term care insurance is very expensive

This is another myth that most people have regarding insurance. Many government policies subsidize long-term insurance. All you need to do is be aware of these policies. Before making up your mind, you need to search government sites and ask your agent.

These were a few common myths that we cleared for you. If you still have any other reservations, you should consult an elderly law lawyer. We will now talk about various long-term care options available for you to choose from. You will see how flexible they are and how they ensure your care.

Today’s Senior Care Options

We have cleared your myths regarding a long-term care program. We will now see what the available options are? Why do we recommend choosing a long-term care program rather than any other option?

The basic types of long-term care are home care, retirement homes, community living, and nursing homes. They all provide rehabilitation, medical care, and personal assistance in their way. Let us discuss them one by one.

Home care services

These services are most sought after by the elderly worldwide. Here you can stay at your home while receiving the care you need, and thus it ensures your freedom.

In these services, your household work like laundry, cleaning, food preparation is taken care of, and also they will take care of your hygiene.

Any trained professional will come regularly or whenever you request to assist you in your medications or any medical emergency. This option is the most optimum for those who need care, but they don’t want to leave their house for nursing homes or others.

But as with my impressive things, there is also a negative side to it. What if you have a sudden medical emergency and are not in the state to call somebody? It seems pretty scary.

Before choosing to live in-home care, you can take the advice of a qualified doctor. Then you will know your disease type and advice for staying at any particular place.

Nursing home facility

This option is most suitable for chronic health problems and severe disabilities. Here you will stay between the trained health care professionals who will seek help 24/7. Though this option seems pretty safe and convincing, you have to be entirely sure about this for a few reasons.

Many elderly don’t consider the ambiance of nursing homes to suit their mental health. This option is also not advised for those who cannot stay away from their homes and family. For these elders, the best option is to choose home care services.

Also, before making that decision, don’t forget to cross-check your insurance for the costs it covers. Because at many places, costs might be very high, and if you don’t have coverage for that, your bills will get you by surprise. However, there are still many government-operated facilities that you can look upon.

Community Retirement Condos

This is another good option to choose for living your retirement life at your independence, away from home. They usually are privately owned buildings; they allow older people to live while getting all necessary services like health care, household chores, and personal assistance.

This is an option to consider when your house is in a rural area, and you can’t get your required services there. So you have to move out and shift into an urban area to get them. You also need to consider if your house can or cannot be modified according to your needs before you seek some other place.

As we have mentioned that these are privately owned buildings. So they may charge you a fixed rent and some extra money for the assistance and health care you receive. So make sure you research them before choosing. Also, few government stake organizations provide this facility for an even lesser amount or maybe free.

We have now told you about every available option, so weigh your priorities and choose what is best for your retirement life.

Now that we have completed our discussion about types of long-term services, it’s time we also address one more question. What if you are single and have no kids? Will it change the way you plan your retirement? The answer is yes, let us see why.

Long-Term Care With No Kids

Here we will tell you why you need to plan things differently for your retirement when you have no kids. It is pretty common in today’s society to have no kids. You might be single your whole life or maybe for some other reason. But it completely changes your outlook regarding your finances, property, and old-age care.

But there are ways to cater to these needs and live a peaceful life away from those earthly tensions. Let us look at a few ways to do this.

Taking Assistance From a Bank

Go to a bank whom you trust; you can give control of your properties to them while receiving a good percentage of profits. You can appoint any family member and friend you trust to keep an eye on every decision of your bank regarding your properties.

If you don’t have anyone who can represent you, you can ask your bank to send an agent to get your opinion on their proposed policy. In this way, you will keep control over your property even when you don’t have to maintain it.

Hiring a lawyer

Hiring an elderly law lawyer will help you secure documents that you might need to avail of the government benefits. Also, you can secure your properties by designing your will with their help.

The lawyers will ensure that even if you leave this earth, your assets will be dealt with according to you. And when you are alive, they will make sure that you will get the care you need.

They will be representing you in any legal situation that might arise, and you don’t have to move around and suffer because of them.

Congregate living

When an older person has no support system, his biggest fear is isolation. It can cause depression, anxiety, and low willpower to live.

To prevent them, it is advised to stay in congregational homes, where you can stay with people of your age.

You can socialize, stay active in community services, and most importantly, avoid depression. Services like community homes and condos, retirement homes, and nursing homes are suitable for this purpose.

After knowing about long-term care options for single elderly, we will now tell you why women have to plan, especially for their retirement? What are different factors that make their plan different from that of men?. While answering these questions, we will also tell how women can plan their long-term care plan effectively.

Why Long-term Care Insurance Is Important

On average, for 65-year-olds, there is a 70% chance that they will need some kind of personalized care later in life. And 30% of adults might not need these services immediately. But 20% of 65-year-olds will surely need personalized care for at least five years as they age even more.

Many people are unaware about these statistics, and therefore do not take any long term insurance. Well, the simple answer to that is that the future is uncertain. Right now, your health might seem manageable, and you may have your mobility.

But what if, later in life, any chronic disease pops up and takes away these luxuries. What if you met with a dangerous accident and lost your abilities?

We are not trying to paint a scary picture in front of you, it’s just basic common sense. We are telling you about the uncertainties life might unfold. You might be lacking a long term vision right now, and it is important to take these decisions early on to avoid exponential rise in insurance premiums.

So now that you have seen this knowledge, you might be able to understand why opting for long-term care services is recommended.

Why Women Need to Plan Their Long-term Care

So far, we have looked at general things to keep in mind while planning for long-term care. We will now specify the need for special planning for women. Women are more likely to get divorced than men, and therefore, they are left with the only option of facing old age expenses alone. We already know that a woman earns less than a man and is more likely to be dropped from work than men.

These few factors reduce their savings, and they don’t have much when they retire. Women are more affected by poverty than men, and they are more likely to not have any loved one available to take care of them.

Few other reasons are

- Longevity: women are more likely to live a longer life than men, and therefore they need long-term care readily. As a person ages more and more, they get severely disabled, and therefore, by this logic, women must plan for their long-term care with more caution.

- Lesser financial resources: Women are less likely to have good savings that they can sustain throughout their retirement life. So they sometimes find themselves in debt in old age. Most of the time, they are bound to work at older ages to get a steady source of income.

- Higher Disability Rate: Women have a higher disability rate than men. This is directly related to their higher life expectancy. As they get older and older, their mobility keeps hindering until, at one point, they become completely disabled. In these conditions having long-term care helps as it can provide you the care you need at that time. Therefore, women need to plan their long-term care.

Women Specific Long-term Care Assistance

Now that we told you about women’s problems specifically and why they need to plan for long-term care more carefully than men. We will now talk about certain benefits women have while taking the insurance plan for long-term care.

- Gender Relaxation: While opting for long-term care, women have some advantages over men. Generally, their plans are a bit cheaper than men and also insurance companies readily sign women insurance holders as it provides them reimbursements from the government.

- Government Assistance: Women with limited financial resources also gets government assistance. There are various programs for women falling in this category to get free health insurance, community living places, free health care, and much more.

These are a few steps by which women can be motivated to seek long-term care service. We will now look at how long-term insurance is paid for? What payment cycles need to be followed? Is it that expensive?

Long-Term Care Costs

So far, we have informed you about various options for taking long-term care, the need for long-term care, and why you need to plan. We will now tell you about the costs involved and how we can optimize the cost under certain conditions.

If we consider the average premium for long-term care, it is 7500$ per year for forty years, which translates to 300,000$ and is adequate to be prepared for long-term care. However, we already told you that at least for 20% of the people who will need care for five years, this amount is more than big.

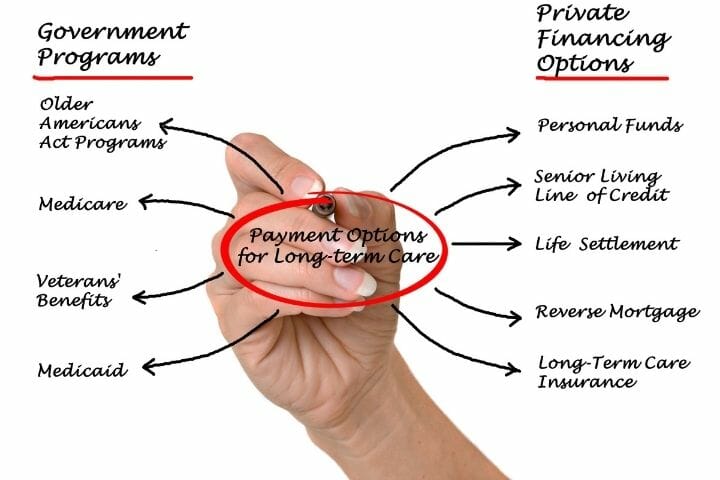

Moreover, most people don’t have that kind of savings as well. So these private long-term care plans are not for everybody. The good thing is to take insurance policy in a coalition of private-public firms. They will offer you much fewer premiums than a private one. Also, check if you are qualified for Medicare as it helps people of low economic background.

Getting Long Term Care Insurance Paid

We told you about the average cost of long-term care. As you can see, the savings that you require for long-term care are vast. That is why it is recommended to have the best insurance policy with an affordable payment scheme.

Let us look at some ways to design your long-term care insurance.

- Transitioning from Term life Insurance: Most people opt for term life insurance during their working life. When you retire, you can meet with your agent and turn it into a long-term care plan with a small amount. It may provide you with monthly payrolls, pay your hospital bills, and many other facilities too. Once you are there to discuss transitioning, discuss the services it will bring.

- Stand-alone Insurance: This type of long-term care insurance gives the option of paying a fixed amount of sum throughout your policy period. But this long-term care insurance is slowly losing its popularity. The reason is that many people cannot afford to meet its fixed payment schedule because of their non-organized mode of work. And they already get qualified for Medicare services exclusively for people with low financial means. If you can afford to meet the requirements of the stand-insurance, then only you should opt for it.

- Hybrid long-term Care Insurance: These insurances are cross-between transition and stand-alone long-term care insurance. You will receive the benefits according to your chosen plan and the investment duration. It offers you the payment scheme of stand-alone insurance, but it doesn’t have a complicated medical care approach innate in it.

Combining Condos To Long Term Care In Toronto

Toronto is currently dealing with the shortage of beds in nursing homes and housing facilities for seniors. The skyrocketing real-estate and lack of space in the city are worsening matters.

In some cases, it forces the builders to move out of cities to consider making new apartments and condos.

There are plans to buy 300 acres of land in west Don Lands, which will add 200 care beds for the elder and families. Trained professionals in these facilities will provide personalized care. Canada is already behind in providing long-term care options to elders, and these kinds of projects will help it reduce the margin.

In Conclusion

In this article, we covered many important topics, and we hope by now you have cleared all your doubts regarding the option of long-term care.

We have discussed various facts and figures that will tell you the urgency to decide on long-term care. We also told you about the various types of insurance policies you can look at before planning your retirement.

We also compared various options available to provide you with the best possible insight into the topic. The special planning needs for women and single senior citizens was also specified.

With an aging population in North America, long-term care is a topic ripe for discussion among laypeople and public-policy advocates. Many universities adn institutions like Texas A&M are leading this discussion.

How to effectively plan? How to seek the help of professionals? How to effectively control your properties despite not managing them. We have talked about it all.

At this point, you can plan long-term care according to your needs and have the best possible retirement life that a smart person can get.